Economic Experience, Tariff revenues, AI Benchmarks, Abundance mindset...

A scarcity mindset always loses, and makes others lose too.

🎧 Listen here or on Spotify.

TLDR

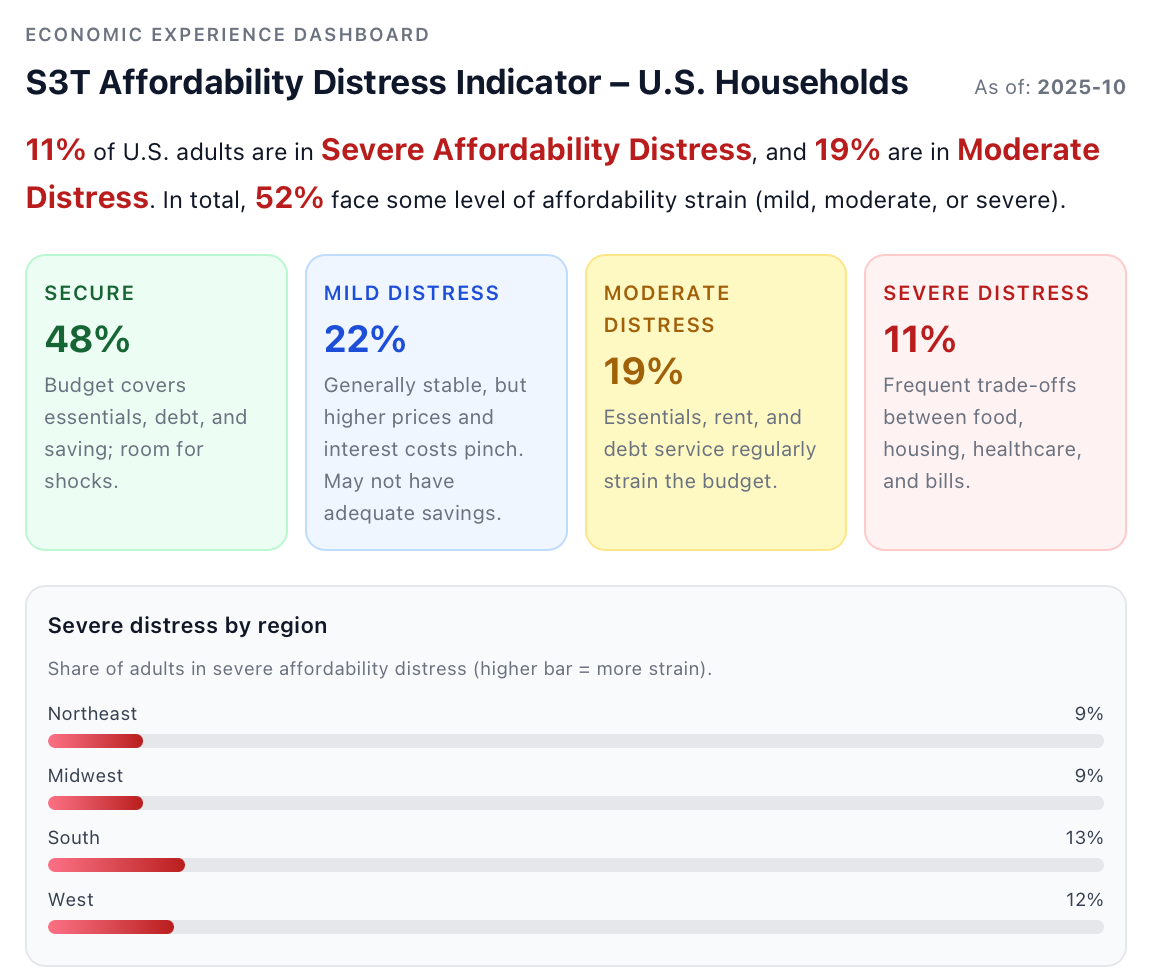

- 📊 Economic Experience Dashboard launched: Traditional inflation metrics miss real household strain; new multi-source indicators show over half of Americans in financial distress.

- 🧮 Tariffs aren’t replacing income taxes: Treasury data shows tariff revenue (~$247B) has peaked and is 10× too small to offset individual income taxes—leaving individuals carrying a disproportionate burden.

- 🪙 Crypto sentiment cooling: With prices down from 2025 highs, investors question whether a new growth narrative exists or whether crypto has entered a structural “lower-range” phase.

- ⚠️ Quantum risk to Bitcoin: A $1.8T asset depends on ~1,200–1,800 open-source developers, while major tech firms have formal post-quantum security programs—raising concerns about Bitcoin’s long-term resilience.

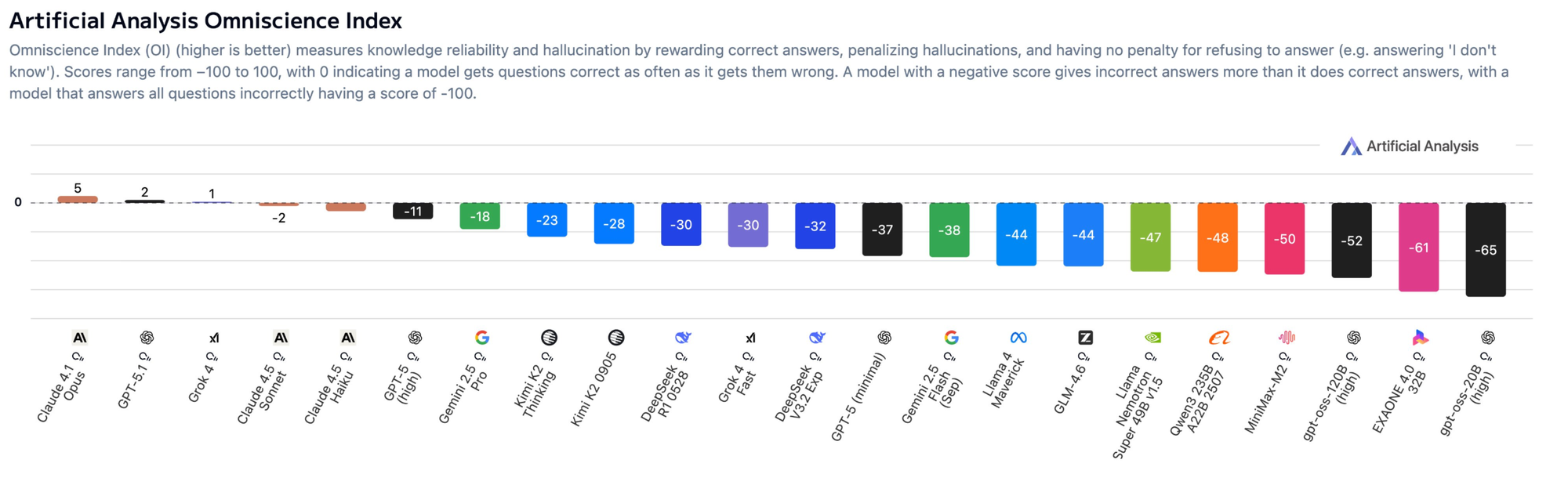

- 🤖 AI benchmarks shifting: AA-Omniscience ranks Claude 4.1 Opus highest in knowledge depth and lowest in hallucinations, reflecting rapid evolution in LLM quality.

- 🏢 Public vs private AI race: Enterprise agents (Databricks Genie, Snowflake Cortex) increasingly match—or exceed—public models thanks to direct access to proprietary data and maturing agent capabilities.

- ⚡ AI bubble signals & phantom data centers: Insider selling, executive warnings, and non-viable data centers without secured power contracts all point to overheating in AI infrastructure investment, underscoring the need for due diligence.

[macro-economics]

🔥Introducing the Economic Experience Dashboard

As noted in previous S3T editions, the current methods of measuring inflation and affordability are flawed.

The Economic Experience Dashboard is designed to provide a corrected view of the actual economic experience of the US population. By factoring together multiple economic data sources we can track the actual financial health and experience of individuals and families trying to balance a budget.

The data gathered for our inaugural publication of the Economic Experience Dashboard suggests that more than half of Americans are currently experiencing some level of financial distress (partial screenshot above).

Click here to visit the S3T Economic Experience Dashboard.

Tariff revenue isn’t changing the math

This analysis of US Treasury Dept data shows the additional revenue being generated by tariffs. Two clear indicators from the data so far:

- While tarriff revenue jumped steeply in the first half of 2025, it is now leveling off as tariffs are scaled back and / or as consumer behavior changes. If it continues to level off, the net revenues will end up being lower than before the tariffs.

- The new revenue is not large enough to achieve the original goal of tariffs which was to “replace the income tax as the main source of funding for the federal government.“

Sounds good in theory: Use income from tariffs to reduce the tax burden on individuals who currently provide a much larger portion of the federal government’s revenue than corporations (even though corporation earn far more). The combined total income of the top 500 corporations is almost twice that of all individuals - yet individuals carry a much bigger tax burden.

But after a little math homework, you'll see this idea turns out to be massively wishful thinking: Per Treasury Dept data the US is on track to collect ~$247 Billion in tariff revenue this year. To offset individual income tax it would have to be 10x bigger.

You can monitor ongoing developments at the Wharton Real-Time Federal Budget Tracker and Tarriff Revenue Financial Simulator.

Full Access Members: See the S3T Economic Dashboard for the Top 500+ US & International real-time economic indicators.

🐻 Crypto Bear market or just a Bull cool down?

Sentiment is shifting in the crypto world. Bitcoin slipped below 86k this week on Thursday, down from 115k a month ago. As the prices fall sharply off earlier 2025 highs, 2 key questions seem to be on the minds of investors:

Question #1 is there a reason to believe in further growth?

As the Economist notes, crypto has become widely adopted across institutions, raising the question of will there be the next big narrative for growth? Or is it all downhill from here?

Key crypto projects have now begun to cannibalize each other’s market share. This started to become evident in the 2024 cycle. See insights and market cap analysis here in this retrospective on 2024 Crypto Market Caps.

Question #2 Are Bitcoin developers (and other crypto teams) serious enough about the threat of quantum computing?

As noted in previous editions of S3T, quantum computers will be capable of breaking the encryption that Bitcoin relies on today (handy Deloitte explainer here).

Bitcoin is currently a $1.7 trillion asset maintained by 1,200–1,800 open-source developers.

Contrast this to other trillion dollar 'assets' one could invest in: companies like Apple, AWS, Microsoft have valuations north of $1T but have hundreds of thousands of carefully vetted employees. They are also highly regulated, and accountable to shareholders. Crucially they have published committed plans for post quantum security.

Examples:

- Apple has introduced PQ3 a post-quantum cryptography protocol using the CRYSTALS-Kyber (ML-KEM) algorithm, with independent security analysis papers (here and here)

- AWS has established an AWS Post- Quantum Security Migration Plan

- Microsoft Post Quantum Security Progress Statement

Bitcoin on the other hand, has multiple Bitcoin Improvement Proposals (aka BIPs), like BIP:TBD and BIP-360 (Bitcoin Improvement Protocol #360) written by someone who apparently prefers anonymity:

To be fair, the BIPs are generally well written and could prove feasible. Also, Hunter Beast and others are certainly entitled to privacy and control over what personal information is disclosed.

But from the POV of an institutional investor, Bitcoin reads like an unusual concentration of value atop a very small, loosely structured and largely unregulated developer community:

- Key leaders operate under pseudonyms

- History of sharp division and forks.

- Has not yet honed in on an agreed approach to ensure Bitcoin can withstand a quantum computing attack.

Unlike the larger more organized efforts of the other Trillion dollar entities, which have clear roadmaps and well funded initiatives, the Bitcoin developer community has proposals which appear to be still very much under discussion.

My Take: crypto always was and probably always will be a risky asset class - that didn't change just because a lot of institutional investors have piled in. Going forward:

- Watch for the emergence of a credible / durable narrative that explains why Bitcoin should go to $1million or any of the other astronomical predictions that have been made.

- If such a narrative doesn't take hold, the asset price may whipsaw within the lower half of its historical range.

- If the Bitcoin developer community doesn't bring forward an actionable Post-Quantum-Security roadmap by mid-2026, we could see more and more institutional investors pulling the plug.

[emerging tech]

AI: The race to actionable insights continues amid signs of a bubble

New benchmark for AI knowledge & hallucination

Artificial Analysis has introduced AA-Omniscience, which uses 40+ topics to measure depth of knowledge and ability to avoid hallucinations. The current rankings show Claude 4.1 Opus in first place - best knowledge, fewest hallucinations.

The race between public vs private AI Agents to produce actionable insights

Public AI Agents like ChatGPT, Gemini, Claude, all have sharpened their ability to deliver actionable insights from data that they have access to. You can ask these agents to analyze large datasets or documents and then produce actionable recommendations and insights - with increasingly impressive results.

But private enterprise players like Databricks Genie and Snowflake Cortex are also catching up and in some examples appear to exceed the abilities of their public counterparts. This is due in part to their ability to connect to proprietary data sources since they operate from inside a company's secured environment. But these players are also maturing and building out the offerings in ways that boost their ability to compete with the public AI Agents who - up til now - have been assumed to be the dominant players.

🧋Latest roundup of AI bubble indicators

- According to filings, Peter Thiel's Thiel Macro sold entire Nvidia stake in Q3 amid concerns about an AI bubble.

- Klarna CEO Sebastian Siemiatkowski is “nervous about the size of these investments in these data centers”

- Sundar Pichai says AI boom has some “irrationality” suggests no company will be immune when AI bubble bursts.

- Which AI companies are most over valued? Conference attendees said they'd short Perplexity and OpenAI at Cerebral Valley AI Conference.

Jensen Huang begs to differ. On the heels of their latest earnings report, the Nvidia CEO said "There has been a lot of talk about an AI bubble. From our vantage point we see something very different."

⚠️Beware of non viable AI data center projects

A growing number of AI data centers under construction actually lack secured power contracts or confirmed grid connectivity(!) Because modern AI data centers require enormous, continuous power (often hundreds of megawatts), projects without guaranteed energy supply are effectively non-viable: they cannot operate, cannot meet SLAs, may struggle to pay contractors and vendors as financing unravels.

Key Takeaway: When evaluating or contracting with data centers—especially new or AI-focused builds—ask direct, detailed questions about their power situation.

- Confirm whether they have executed power-purchase agreements, secured long-term utility interconnection, locked in substation capacity, and obtained firm timelines from the local grid operator.

- Press for documentation, not projections and keep in mind “planned” substations or upgrades may be years out.

In the current environment (where data centers projects without real power access are proliferating) verifying power commitments is essential to avoid non-viable customers, delayed payments, and stranded deployments.

📖AI related playbooks

- Spend Wisely in a Hype-Driven World

- Gaining Buy-in for Data Modernization

- Shift to effective gatekeeping in the age of generative AI

- Validating AI use cases

See Full List of S3T Playbooks

[change leadership mindset]

This week's Change Leadership lesson: The abundant mindset vs the scarcity mindset

Why is an abundant mindset so important? A scarcity mindset always loses, and makes everyone else lose too. An abundance mindset enables more effective solutions to the complex challenges of the 21st century. To find out why and how, click the link above for this critical learning segment.

Click here for an overview of the full Change Leadership Learning Series.

Opinions expressed are those of the individuals and do not reflect the official positions of companies or organizations those individuals may be affiliated with. Not financial, investment or legal advice, and no offers for securities or investment opportunities are intended. Mentions should not be construed as endorsements. Authors or guests may hold assets discussed or may have interests in companies mentioned.

Member discussion