2025 in review: broken assumptions, radical departures that set the stage for 2026

Do we want a world run by Artificial Intelligence or Accountable Intelligence?

🎧 Listen here or on Spotify

🎄Happy Friday and Happy Holidays!

Welcome to the last edition of 2025! We will resume in January with a special edition outlook for 2026 and beyond.

This special issue is a wrap up of the biggest developments in 2025 that offer clues on how to prepare in 2026.

Thank you again for reading and sharing S3T this year, and thank you for your commitment to change leadership: driving intentional innovation and beneficial change.

Hope you have plans for some downtime and reflection during this holiday season, and best wishes for success in the New Year!

Ralph

2025 in 1 minute

- 🌍 2025 broke core assumptions: AI shifted from experimentation to execution but hit hard constraints (energy, chips, geopolitics), inflation and volatility became structural, and financial innovation moved from fringe to center stage—rewarding discipline over hype.

- ⚡ AI became a geopolitical topic but not a guaranteed ROI engine: Governments now treat AI like oil, racing to secure energy and compute, yet only ~15% of executives saw profit gains, exposing overinvestment in flashy AI versus durable, platform-aligned capabilities.

- 🏦 Platform-first AI is emerging as a winning pattern: Firms like BNY Mellon focused on core data, risk, and compliance-aligned AI foundations—illustrating that scalable value comes from infrastructure discipline, not one-off AI experiments.

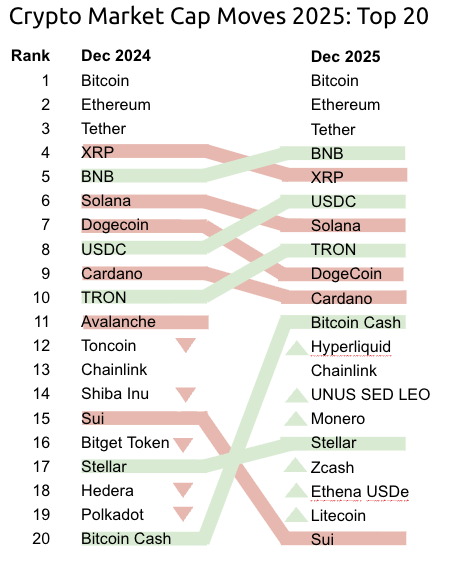

- 🔗 Crypto is bifurcating: speculation down, utility up: Meme, and volatile “store of value” coins broadly lost ground in 2025, while assets tied to transaction flow (USDC, Tether, BNB, Bitcoin Cash) gained—signaling investor preference for rails, cash equivalents, and real usage over narratives.

- 🧾 Tokenization entered mainstream finance: Regulated assets are moving on-chain (BlackRock, BNY Mellon, Goldman Sachs, Kraken), modernizing settlement and record-keeping without changing asset risk—shifting finance from batch-based to near-real-time architecture.

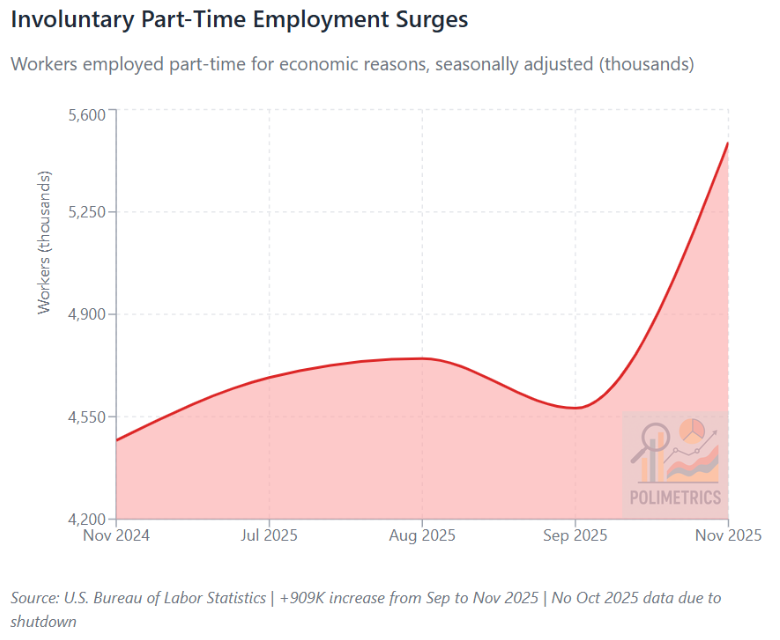

- 📊 Fiscal and labor signals stayed stressed: Government tax and spending both rose, inflation remained above target, layoffs quietly accumulated, involuntary part-time work surged, and tariffs proved insufficient to meaningfully replace income tax revenue.

- 🧭 2026 leadership question: As constraints tighten and systems modernize, the advantage shifts to leaders who choose accountable intelligence over raw automation—making disciplined, trust-aware decisions in a world defined by limits and constraints, not abundance.

[2025 in Review]

Top developments in 2025 that set the stage for 2026

2025 was a year of radical departures and rifts—from experimentation to execution in AI, from abstract debates about compute to hard constraints driven by energy, chips, and geopolitics, and from speculative crypto narratives to regulated financial infrastructure built on stablecoins and tokenization.

Economic conditions shifted from pandemic recovery to a new "normal" of permanently higher inflation, tariffs, volatility, and a stalling job market. Meanwhile global power dynamics increasingly linked technology leadership to energy security and supply-chain resilience. Together, these changes broke some long standing assumptions:

- That software could scale without any real physical limits (it can't)

- That globalization would recover and continue (not likely)

- That financial innovation would remain peripheral (its now center stage)

Which raises the question: will 2026 winners be those with vision or those who make disciplined choices under constraint & uncertainty?

AI became the new Oil in Geopolitics in spite of elusive ROI

AI now occupies the same brain space and level of urgency that policy makers and governments in past decades devoted to oil supply chains. Nations race to build up energy and compute value chains for AI datacenters with city-size power needs.

For all this, the actual ROI for companies that adopted AI remains fuzzy. Just 15% of execs saw profits improve due to AI. Many are realizing they over-indexed on buzzy flavors of AI while leaving other versions of the technology unleveraged.

One exception: BNY Mellon took a platform approach to AI, building a core set of capabilities aligned to their data needs, risk tolerance and compliance requirements. Read their lessons learned here. (Related: BNY Mellon and CMU team up for AI advanced research and development).

Crypto tech is maturing into a preferred model for transactions and tokenization

2025 saw highly favorable conditions for crypto as an asset class, with strong institutional investor adoption and increasingly favorable regulatory environment (especially in the US).

But not all classes of crypto were impacted positively. Many lost significant market cap or rank.

Many speculative meme coins, utility coins and store of value coins saw significant market cap losses in 2025.

Utility coins like Render, Helium, Chainlink (and many more) are designed to enable a specific platform or service. Investors generally expect growth in user adoption to drive increases in the value/price of these utility coins. With a few exceptions, most utility coins have not seen strong adoption in 2025 and many of the old favorites fell sharply this year. They don't solve a compelling enough need. Some of these first generation utility coins may be headed for extinction.

Store of value coins like Bitcoin are seen by some investors as hedges against inflation (a digital version of gold). But these value stores are also highly volatile and are considered risky assets. In uncertain times, many investors dump risk assets in favor of assets with more stable value. Traditionally investors sought refuge in US Treasuries, in more recent times Bitcoin investors sensing first signs of crypto winter, or economic trouble may convert Bitcoin to stablecoins (like USDC).

Its educational to note which assets saw large gains, and what those assets have in common. Contrast the red/green figures in the last column:

The table above shows 4 leading assets that experienced significant market cap gains in 2025: Tether, BNB, USDC and Bitcoin Cash. What do these 4 have in common?

- They're used not just traded: their value is tied to transaction flow vs investor sentiment and speculation.

- They function as rails, cash equivalents or other high utility instruments, not just memes or experiments.

- Investors see them as a less risky way to retain exposure to crypto's upside potential. Bitcoin by contrast is seen as risky and large institutional investors frequently dump Bitcoin when facing uncertain macro environments.

Tokenization is bringing real-time architecture to traditional finance

Tokenization is entering a mainstream phase, where regulated assets (vs NFTs etc) are moving on chain.

- Blackrock has gone public with their enthusiasm and plans for tokenization

- BNY Mellon and Goldman Sachs launched a shared ledger for Money Market Funds

- Kraken launched tokenized stocks & ETFs earlier this year for non-US customers for 24/7 trading - and plans to go public in 2026.

Tokenization in this context means representing the ownership of a regulated financial asset (e.g., a bond, money market share, or equity) as a digital token that can move on modern distributed infrastructure.

Worth noting:

- Tokenization itself does not change the nature of an asset; its credit risk, regulatory status, investor protections are not impacted by the fact that it runs on a shared ledger/blockchain.

- Tokenization does change how ownership and transfers are recorded, settled, and managed.

Analogy: Instead of moving value by faxing confirmations, batching settlements, and reconciling ledgers, tokenization updates a shared “book of record” faster - with fewer intermediaries.

- Board of International Organization of Securities Commissions report on Tokenization of Financial Assets

Takeaway for investors and decision makers in 2026: Don't underestimate crypto: this technology is maturing into a preferred transaction and tokenization model and should not be seen simply as a store of value for risk-tolerant crypto holders.

Government Tax & Spend Trended higher in 2025

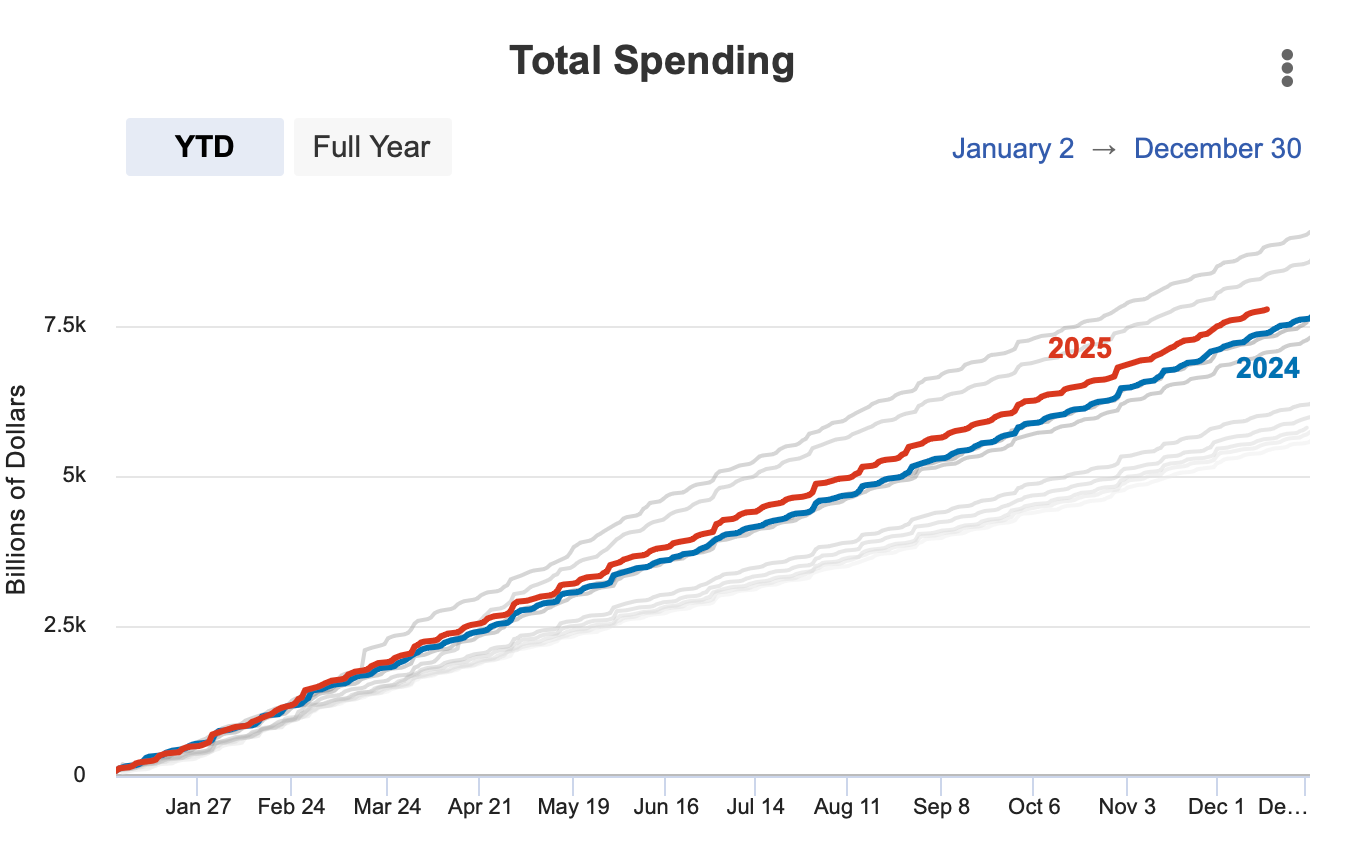

Contrary to hopes for lower taxes and more fiscal discipline, the federal government's tax & spend both trended higher this year.

The federal government taxes (after refunds) rose in 2025:

Total government spending also rose noticeably, in spite of the DOGE activities in early 2025.

Inflation is still above target and the job market is basically flat

The US latest inflation figures this week came in lower than expected, apparently due to flawed assumptions about price changes in the October-November timeframe, as well as holiday discounts during the Thanksgiving timeframe. A more reliable read is not expected until January when the full data collection occurs for the month of December.

"The data is truncated, and we just don't know how much of it to trust." said Diane Swonk, KPMG chief economist.

BLS figures show little change in employment over the course of 2025, as more and more companies are resorting to continuous small layoffs. Announced layoffs have totaled 1.17M this year.

Dalin Overstreet notes that one of the most significant developments this year is the surge in involuntary part time employment - people who want full time employment but can only find part time.

Tariffs aren't bringing in enough revenue to replace the income tax as the main source of funding for the federal government

This analysis of US Treasury Dept data shows the additional revenue being generated by tariffs (~$250B in 2025 far short of the 2.4Trillion needed to offset income tax revenue).

Looking at the details in the Reed Smith Tariff Tracker helps you see why. Most of the implemented (not threatened) tariffs come attached with hundreds of exemptions, from coffee, spices, fruit, animals, wood products, rare earths and ores, pharma components, aircraft parts etc...leaving one to wonder what if anything is materially impacted by Tariffs??

What to make of it all here at the end of 2025

Taken as a set these developments show a rapidly accelerating evolution of emerging technology alongside an increasingly challenging financial picture for individuals and industries alike. The leadership opportunity can probably be summed up in this choice: Do we want a world run by Artificial Intelligence or Accountable Intelligence?

All of it will make for some very interesting times in the year ahead. And we will be here to talk about it and figure out the path forward together!

Full Access Members:

- See the S3T Economic Dashboard for the Top 500+ US & International real-time economic indicators.

- S3T Economic Signals: Top Sources for economic data and insights

Opinions expressed are those of the individuals and do not reflect the official positions of companies or organizations those individuals may be affiliated with. Not financial, investment or legal advice, and no offers for securities or investment opportunities are intended. Mentions should not be construed as endorsements. Authors or guests may hold assets discussed or may have interests in companies mentioned.

Member discussion