Comparing taxes on individuals vs companies

The latest data shows total earnings of individuals vs total earnings of companies continue to be lopsided. But not as lopsided as their shares of taxes.

- The total income of all US individual wage earners (from salaries, rental properties etc) was $23 Trillion (for 2023).

- The total income for all US Corporations is not aggregated, but Fortune 500 companies made $41Trillion in total revenue in the FY ending in March 2023. Together US Corporations earn about 3 Trillion profit per quarter or ~12 Trillion per year just in profit alone.

To run through the numbers again:

- $23 Trillion = Total income for all US individuals

- $41 Trillion = Total income for top 500 US companies

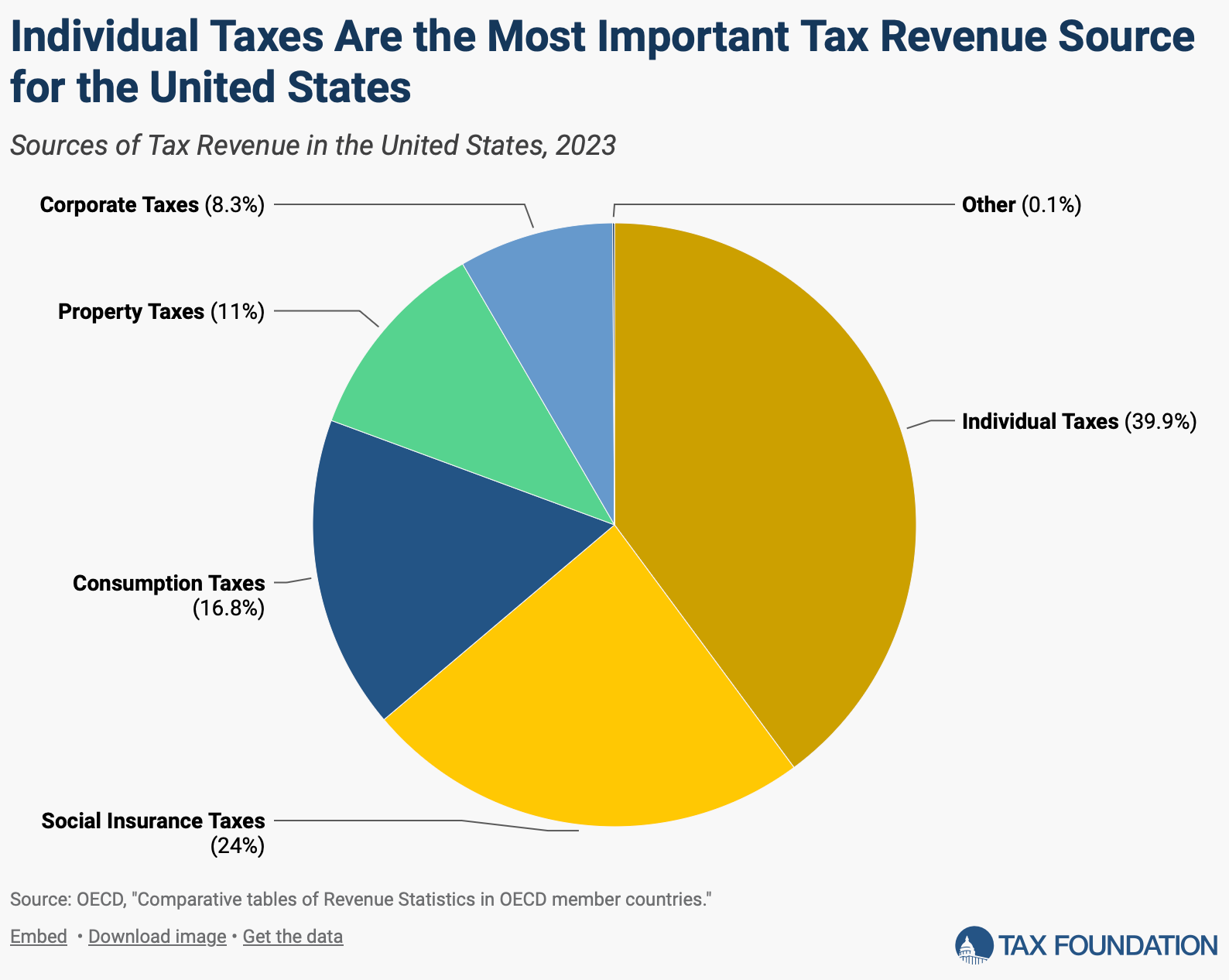

So naturally total corporate taxes should be equal or maybe almost twice as much as total individual taxes - right? Well...see the chart below, which shows latest full accounting of US Gov tax revenue:

- US Corporations pay a fraction of the taxes individuals pay.

- Individuals carry a multiple of the tax burden that corporations pay, and pay additional taxes via social security taxes, property and consumption taxes.

Link to original with full context, courtesy of the Tax Foundation. This was not an unusual year - here is the same chart for 2023. And 2022.

The top 500 companies alone make almost twice as much as the total wages of individuals, yet consistently pay 1/4 of the tax burden.