🎲 Feb 13: Crypto's growing pains

🎧 Listen here or on Spotify

🎲 Why Does Crypto Suddenly Feel Unlucky?

It was all going so well....

If you are a developer, you may be wondering whether it is still worth investing time learning blockchain and crypto technologies — or whether the market is quietly moving on to something else.

If you are an entrepreneur, you may be trying to decide whether crypto-based architectures belong in your next product at all, or whether the opportunity now lies somewhere adjacent to crypto rather than inside it.

If you are an investor, you are likely asking a different question:

why are prices falling in areas that were supposed to be the next wave of growth, and why does capital suddenly seem to be flowing toward tokenization, payments, and institutions instead of the alt-coin ecosystem?

And if you are simply curious about all the attention crypto continues to receive, you may feel a deeper confusion: crypto was supposed to replace banks, disrupt Big Tech, and create a new internet — yet the biggest activity today seems to involve asset managers, payment rails, and settlement systems.

We are going to walk through a sketch of what is actually happening inside the crypto market right now — not the headlines, but the structural shift — so you can understand how the technology is evolving and why this space may suddenly feel so unfamiliar.

Because some strong headwinds are forcing new directions for crypto. But its not all bad...

The Crypto Alt-coin pattern is broken

For years crypto bull markets seemed to adhere to a predictable 3 phase pattern:

- Bitcoin halving (halving the rate of rewards for miners)

- Bitcoin bull market

- Alt-coin bull market

(Alt-coin = lesser known cryptocurrencies with smaller market caps).

If you think about it, it kind of made sense: the halving increased the scarcity of Bitcoin, a stark reminder that - unlike government issued currencies, Bitcoin is programmed for controlled scarcity and therefore inflation resistant in ways that dollars and other government issued currencies can never be.

Bitcoin bull runs spawned excitement for the overall crypto sector, inciting curiosity and investment into other crypto assets (the so-called alt-coins). As Bitcoin reached new all time highs, investors would collect profits and pump them into alt-coins, which in turn would also rise. Investors learned to expect and leverage this seemingly reliable pattern. Bitcoin bull run, then alt-coin bull run.

However, as NLW noted in this recent podcast, this old familiar pattern definitely did not play out in 2025.

This is an important inflection point for the digital-asset market. So what is going on?

4 Headwinds for Crypto

#1. Coinbase and other exchanges are driving a dilution effect

Coinbase has rolled out stocks, futures and sports-betting all while continuing to roll out a variety of alt coins. This week alone several were green lighted. Potential investors are now confronted with an ever widening array of things to do with their money (many of which cannot seriously be considered investments).

#2. Tokenization of everything pits Digital Gold against Real Gold

PAXgold (a tokenized way to buy and sell gold) may be eroding the narrative of Bitcoin as "digital gold". Unlike Bitcoin, PAXgold's value is pegged to the current price of gold, and has seen strong adoption even as Bitcoin prices are sagging. So does this mean that bitcoin will see a mass exodus as investors move to tokenized offerings like PAX? Maybe.

#3. The ratio of Maverick to Mainstream investors has flipped

Back in 2021 I wrote that crypto investors could be categorized as either Mavericks or Mainstreamers.

- Mavericks = - the original diehard Bitcoin (and altcoin) HODLrs. Mavericks who were the original investors in Bitcoin, recognized it was the first form of money that was not sanctioned or controlled by a government. They recognized an opportunity. These conviction driven investors believe central banks and fiat currencies are fatally flawed and that crypto offers a better future that is well worth the risk and volatility.

- Mainstreamers - the newer entrants (institutional and retail investors) who didn’t want to miss out on huge gains they were hearing about. Today's Bitcoin investors may be largely investing out of FOMO, or just because their RIA told them it was a good idea.

My expectation (not original with me - held by others too) was that conviction driven investors (Mavericks) would eventually be outnumbered by mainstream investors, and as this happened the market economics and behavior of the crypto market would change. Markets after all are mirrors of human psychology.

We are in an era of where the investors with conviction have been outnumbered by the investors who have no long term conviction or loyalty to Bitcoin or any asset for that matter. They will invest based on impulse, groupthink or what influential figures tell them.

#4. Functional Alt-Coin projects have had limited success so far

Functional alt-coins (does NOT include non-functional meme-coins like Doge etc) create participation models that allow individuals to take a stake in a decentralized application or platform. Some of these are projects have some interesting potential A significant portion of functional alt-coin projects — like Render and Helium — were built as direct challenges to traditional centralized technology platforms. Their core thesis was that centralized social media and content platforms fostered an imbalance where users and creators generated the activity, data, and content that made the platforms viable, but platform owners took the lion's share of the economic returns.

Whether or not one agrees with the critique, this grievance-driven narrative became a primary catalyst for investment and entrepreneurship across the alt-coin sector. Unfortunately, it turns out that many of these grievance-driven business cases were not based on solid due diligence required to define a durable business model...or at a minimum have encountered unforeseen challenges.

Do some people want to buy dash cams that allow them to contribute to an alternative to Google Maps? Maybe. But what are the odds that they'll earn enough crypto tokens to make this worth while? What are the odds that there will be enough users to eventually sustain a viable business model? Not good. Not as long as Apple and Google own the starting point for maps (phones).

Retail investors who bought into these ideas have generally not had a good experience.

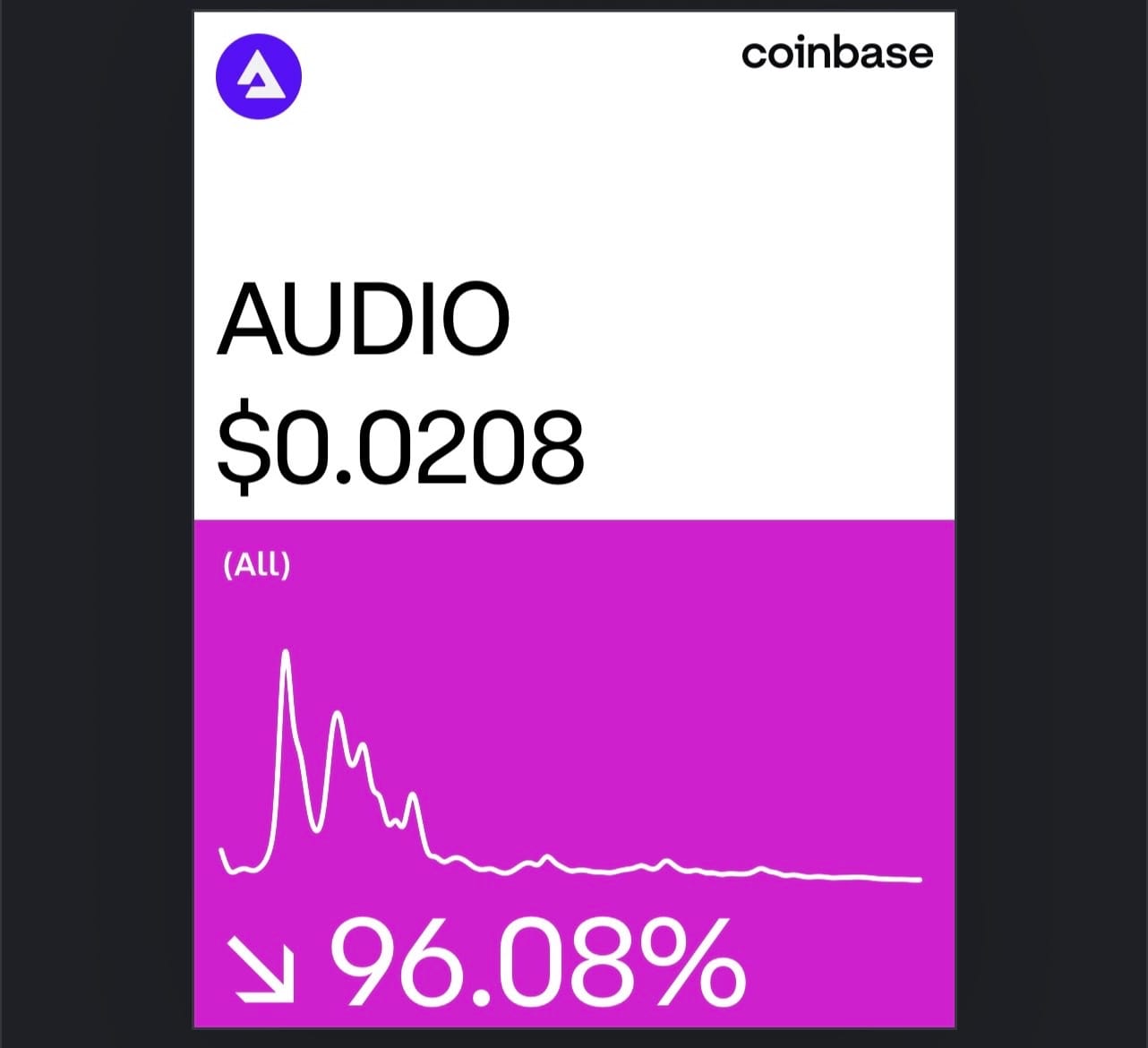

Case in point: back around 2021 Coinbase launched a music focused cryptocurrency called Audius (AUDIO) which in the years since has lost 98% of its value (snapshot of this weeks price below).

This however did not dissuade Coinbase from greenlighting another music cryptocurrency RaveDAO (RAVE) just this week. At time of writing it was down 10% from its original price.

The next maturation cycle

Crypto is here to stay but its maturation is not going to necessarily trace the expectations and ideologies of the early years. The Alt-coin projects mentioned above tend to cast crypto as a replacement for consumer applications. It may yet turn out to be "the new internet that replaces companies" like some Decentralized Autonomous Organization advocates have suggested.

But what is more likely - and easily observable right now - is that crypto is evolving into a financial infrastructure technology, not so much a consumer application. Think of it as an upgrade to the financial system, not necessarily a replacement of the financial system. Crypto is not disappearing. It is moving down the stack.

And it is going through the difficult and not fun process of maturing and diversifying.

- Crypto is getting serious about Post Quantum Security - Ethereum Foundation and Coinbase both announce initiatives.

- Crypto Payments for AI Agents represent the emergence of a new competitive field. The battle for control of the next generation of payments — especially in the context of AI-driven applications — is heating up.

Maturing technologies tend to show three characteristics:

- Institutions begin using it

- Regulators begin defining it

- The use cases shift from speculation to efficiency

Crypto is now showing all three.

Positioning

For participants in this space — developers, founders, and investors alike — these developments are not a call for abandonment but realism. Crypto is maturing, and maturing markets behave less like movements and more like industries. Some narratives will fail, some architectures will persist, and others will find applications very different from what was originally imagined.

The appropriate posture now is eyes wide open: build and invest with clear-eyed expectations. Expect long stretches of unfavorable pricing. Be prepared to pivot as real economic use cases reveal themselves. Bear markets are not interruptions to the technology cycle; they are the mechanism through which durable models are discovered and weaker ones are filtered out.

What to watch for next week: China is set to release a new set of low cost AI models during the annual holiday season that starts Feb 15. We will delve into how the economics of AI consumption may be changing.

[S3T playbooks]

- Spend Wisely in a Hype-Driven World

- Gaining Buy-in for Data Modernization

- Flipping the Script: Understanding and Changing Internal & Macro Narratives

- Shift to effective gatekeeping in the age of generative AI

- How to Stop Zombie Projects from Sapping your Focus and Resources

- Harmonize Different Kinds of Expertise to Achieve Success

- Addressing issues related to uneven accountability

- Validating AI use cases

- 6 Proven Ways to Resolve Conflicts

See Full List of S3T Playbooks

Opinions expressed are those of the individuals and do not reflect the official positions of companies or organizations those individuals may be affiliated with. Not financial, investment or legal advice, and no offers for securities or investment opportunities are intended. Mentions should not be construed as endorsements. Authors or guests may hold assets discussed or may have interests in companies mentioned.

Member discussion