S3T - Mar 6: Big Sorts, Ripple effects, Artists, Poets, RIAs, DACS, Shifting priorities...

As Ukraine war opens a new chapter of world history, a big sort is playing out, in America and globally. Like-minded nations and like -minded groups are banding together. A new twist for the dawn of decentralization. Will we see a shift in investment priorities?

Ukraine

The Artists and Poets

- Art from Ukraine - Ukranian artists are bearing witness with their art - poignant selection from current artist living and working in the war zone. Below, a remembrance of Ukrainian Poets from the Soviet era.

"Ukrainians know the price of freedom. They remember the lives and works of their poets." Myroslav Laiuk on the disappeared writers of the Soviet Union. https://t.co/NbnTVKMgPM

— Literary Hub (@lithub) March 5, 2022

Economic Ripple Effects

It is dawning on leaders - corporate and political - that the Russia Ukraine situation will have a lasting impact. Here are two detailed analyses of how the war disrupts Russia and Ukraine's production of energy, base metals and food, and how the impact of this disruption will be felt around the world:

- Expect high commodity prices, supply chain disruptions, global inflation and regional recessions says EIU Viewpoint.

- Why the timing of this war - on the heels of a pandemic and runaway inflation - risks an economic catastrophe warns World Bank.

- Global insurance and reinsurance face significant exposure.

Companies around the world will be impacted as supply chains are redrawn from global to multi-pole arrangements, and nations execute rapid shifts in energy sourcing, while grappling with inflation and economic uncertainty.

Web3: Building the next financial ecosystem

Crypto as a war time asset

Crypto's unprecedented financial capabilities are being used by both sides in the Ukraine war with no shortage of confusion.

(Forbes March 2, 2022)

Crypto as a way to prepare for the future

The global chaos and uncertainty seems to be spurring continued focus on joining and building out the next generation financial ecosystem. Previously the motivation was that the old ecosystem was so inefficient and fueled so much inequality. Today a new emerging motivation to accelerate the next generation financial ecosystem: the current system seems so ill prepared for the realities we face in 2022.

- Citi exec Morgan McKenney leaves traditional finance to join Provenance Blockchain Foundation.

- IMA Financial - a Denver based top insurance broker goes crypto: plans to offer insurance for NFTs.

- 12% of first time home buyers used crypto to help with down payments in 2021 per a Q4 2021 survey.

- 61% of Registered Investment Advisors (RIAs) are considering or already are investing in crypto for themselves or their clients (Tweet below).

We presented DeFi to 400+ RIAs last week, and the polls are in:

— Ryan Rasmussen (@RasterlyRock) February 28, 2022

61% are considering - or already are - investing in crypto for themselves/clients

48% have heard of DeFi

38% have used a crypto wallet

19% have used a DeFi application

Roadmap for Investors: Digital Asset Classification Standard

RIAs and Investors finally have a standard taxonomy for classifying Digital Assets: The Coindesk Digital Asset Classification Standard (DACS).

Problem this solves: investors managing a portfolio of digital assets usually want to diversify across multiple sectors. In the crypto space it has been challening to figure out how to meaningfully categorize individual digital assets by their function and likely future place in the economy.

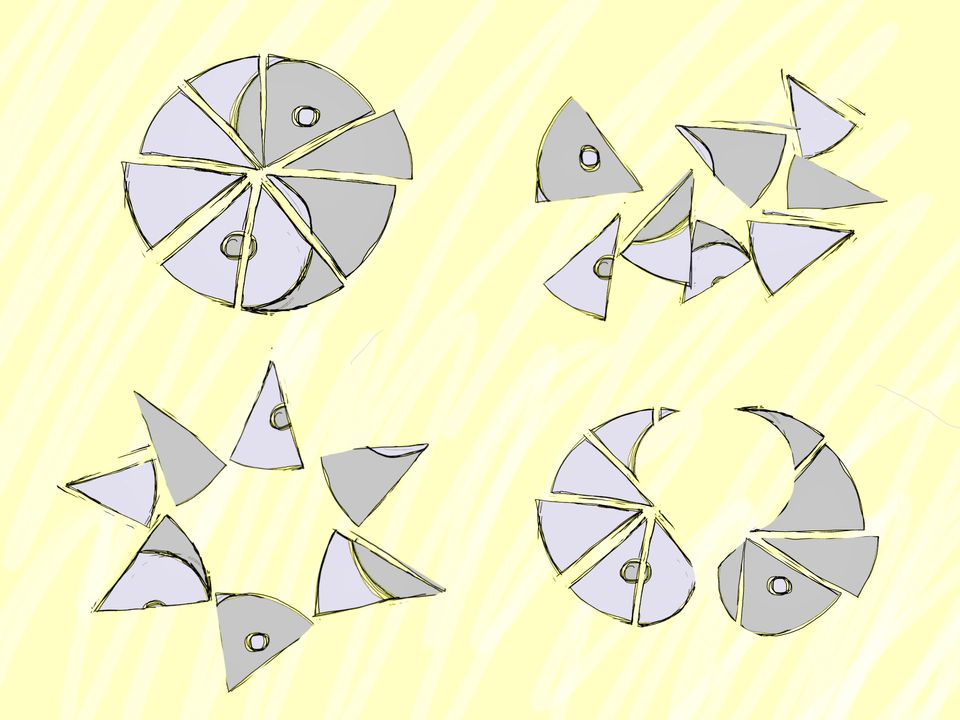

Coindesk's Digital Asset Classification index provides handy sortable list of top 500 Digital Assets organized as a 3-tier system with 6 sectors, 21 industry groups and 36 industries.

DACS provides a roadmap for investing, and also an indication of the mindboggling comprehensiveness of the growing Web3 space.

Sorting the Messy World Order

Global Sorting: Kindred Spirits

Francis Fukuyama predicted the world would sort into multiple poles. The events in Ukraine and the economic sanctions in response will only accelerate this. Azeem Azar argues this requires "rapid investment in technologies that, frankly, are not dependent on fossil fuels or extended supply chains" (Excellent essay here).

21st century threats posed by pandemics, economic instability and autocratic rogues will bolster collective action among "kindred spirit" nations notes the Editor's summary of the 2021 Military Balance, the respected annual journal that analyzes and ranks the world's military capabilities. (Highly recommended - not your typical editor's note: meaty analysis of rapidly evolving military technologies and skills).

National Sorting: People like me

Americans seem to be moving to towns where people think like they do but is this a good thing? Uhaul and United Van Lines annual migration reports suggest that people moving for reasons other than jobs. One notable theme is moving to be closer to family. Will this result in increased polarization of our national discourse? Or will it result in more quality conversations and mutual respect?

Related themes: shifting investment priorities?

Together these points suggest we may see a shift in investment priorities perhaps accelerated by the Ukraine crisis:

- The reduction in reliance on fossil fuels has been underway, but the Ukraine crisis demonstrates just how much work remains.

- The shift from global to regional manufacturing, and reorganizing supply chains around kindred spirit nations will be complicated and will take time. 100% regional or national independence is unrealistic. Certain materials are likely to still come from "non-kindred-spirit" nations.

Will this translate into an emphasis on investment in "hard capabilities" vs consumer capabilities? If so, how will this impact the availability of capital for the play to earn gaming, memecoin, NFT Ape trading sector? Will we see a growing sentiment of "Ape JPEG business models can wait, we've got supply chains to fix"?

Nature Notes

Holding Banks Accountable for Climate Destruction

Several of the world's largest banks continue to finance climate destruction. Their customers are plotting a mass exodus and transfer of funds timed for maximum impact to occur later in 2022. Learn how you can get involved at the link below:

Happy to see this engagement with the banking system. As noted in previous editions of S3T, certain economic roles have outsized impacts on other players in the economy - forcing bad choices or enabling good choices. Banks and financial services leaders certainly occupy some of these economic roles.

Those who occupy these roles often have a mental model that accepts a false trade off: that one can have economic growth OR healthy natural ecosystems, but not both. Growth at all costs has been the unquestioned dogma. The recent economic shocks are forcing us to rethink growth. More on this next week.

Spring Bird Migration

In the next few weeks, millions of birds will begin their journey's north to their summer breeding grounds. Birdcast will resume its bird migration forecasts on March 15.

Final Note

As I write this, news is spreading of people who are booking AirBnB's in Ukraine as a way to get funds quickly to citizens of Ukraine. Unprecedented times. Thank you again for reading, and sharing with friends. I hope you have a good week ahead. Feel free to visit S3T Discord or Twitter. Stay safe.

Ralph

Opinions mine. Not financial advice. I may hold assets discussed.

Member discussion