🎃Oct 31: “AI’s Shockwave: White-Collar Layoffs, Pharma Supercomputers, Is Progress Affordable? 💥”

Change Leaders don’t downplay risk — they dissect it.

🎧 Listen here or on Spotify

In this Issue

🔹 AI Reshapes White-Collar Work

- Major firms (Amazon, UPS, Target, Coors, automakers) are cutting staff as executives bet AI can replace or augment many white-collar roles.

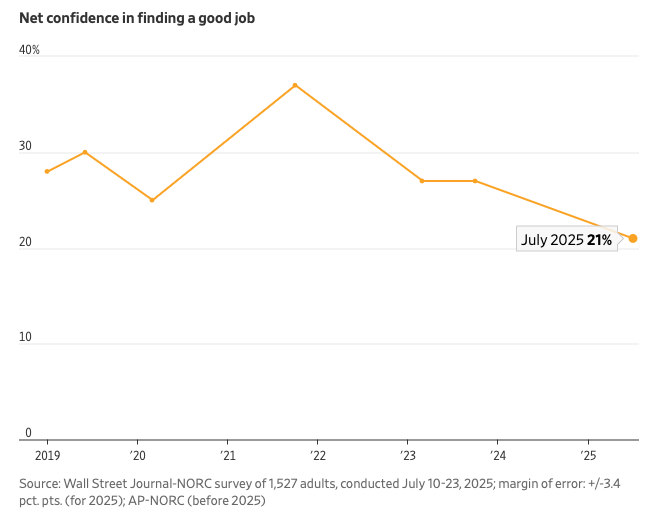

- Confidence in the job market is now at a 6-year low (WSJ).

💸 CapEx Boom, Jobs Pause

- Billions are flowing into AI infrastructure—cloud, chips, and data centers—creating short-term labor displacement but long-term hopes for new AI-powered industries and employment cycles.

🧬 Pharma’s AI Arms Race

- Eli Lilly & NVIDIA built the most powerful pharma supercomputer (1,000+ Blackwell GPUs) to accelerate drug discovery and production.

- Early adopters owning their own compute—not renting cloud—may gain durable R&D speed advantages.

💊 Affordability Risk & Financial Innovation Need

- Pharma’s AI megaspends could push drug prices higher; leaders must pioneer shared-infrastructure, tokenized R&D, or outcome-linked financing to avoid shifting costs to patients.

⚖️ AI and Market Efficiency

- AI is narrowing information asymmetry—reducing the “rip-off economy” by giving consumers data once reserved for sellers and intermediaries.

- But fewer intermediaries could also mean lost jobs and new fiscal stress points.

💰 Crypto & Fintech Modernization Wave

- Coinbase enables free off-chain payments via phone/email; MetaMask preps IPO; Mastercard buys ZeroHash; Google opens Play Store to alternative payments.

- These moves extend the “Magnificent 7” story into wallets, payments, and digital ownership—broadening tech’s growth narrative.

⚙️ AI Energy & Infrastructure Cascade

- Amazon’s $11 B AI data center (training Anthropic models) triggers a domino of energy and gas investments while Big Tech’s Q3 AI CapEx hit $80 B.

- Massive infrastructure bets show AI’s real-world footprint—and hint that precision, not hype, will separate sustainable gains from bubbles.

✅ Takeaway for Change Leaders: The 2020s challenge isn’t just smarter AI—it’s ensuring AI-driven productivity doesn’t erode affordability or access.

[macro economics]

AI based layoffs: White collar jobs disappearing

As noted earlier Amazon has announced plans to lay off 14,000 workers. UPS, Target, Coors and several automakers have also made large workforce reductions. The noticeable trend: "executives hope can handle more of the work that well-compensated white-collar workers have been doing." WSJ finds that confidence in the job market has fallen to a 6 year low.

This may be cyclical. Right now the big $$$ are going to AI infrastructure, in hopes that this will create a new foundation of intelligent compute that powers the businesses and growth engines of tomorrow. If this new generation of AI powered businesses does emerge, one can hope they will generate a new wave of jobs - just as previous waves of innovation did.

Pharma invests in AI: New costs for healthcare

Eli Lilly & Company has partnered with NVIDIA to build what both firms call the most powerful supercomputer ever operated by a pharmaceutical company. The system—powered by 1,000+ Blackwell GPUs—will serve as Lilly’s “AI factory” for accelerating drug discovery, clinical development, and manufacturing optimization.

→ NVIDIA Blog Announcement

→ Reuters Coverage

Several key takeaways for Change Leaders:

- Pharma Strategy: This marks a structural shift in how large pharmaceutical firms compete—owning proprietary compute capacity rather than renting it from cloud providers. Such control could accelerate drug discovery and production timelines, potentially giving early adopters a durable edge.

- Infrastructure Economics: For NVIDIA and data-center operators, this broadens the AI demand base beyond tech and finance, which at least incrementally increases likelihood of longer term ROI.

- Cost Risk: These multi-billion-dollar infrastructure investments introduce a new layer of capital cost that likely will be passed downstream to healthcare consumers through higher drug prices and system costs—at a time when U.S. households already face record levels of medical debt.

- Need for Financial Innovation: To prevent further erosion of affordability, the healthcare sector will need innovative financing mechanisms—for example, shared infrastructure funds, tokenized R&D financing, or outcome-linked investment models—that allow major AI capital formation without transferring the burden to patients.

For innovators and policy leaders, this development underscores a critical leadership challenge of the 2020s: how to sustain AI-driven productivity gains while protecting consumers from cost inflation. The sector’s next frontier isn’t just AI innovation—it’s financial innovation that makes such progress socially and economically sustainable.

Full Access Members: See the S3T Economic Dashboard for the Top 500+ US & International real-time economic indicators.

AI may be changing the information asymmetry issue in markets

One of the Achilles heels of the free market economy is the problem of information asymmetry: where one party (usually the seller) has information that the other party (usually the buyer) doesn’t have. In 2015 this paper hypothesized that AI would reduce information asymmetry in markets, since AI agents would be better able to gather, process and retain large amounts of information.

More recently information gathered by the Economist suggest that this is actually coming to pass: AI is ending (or at least reducing) the rip-off economy.

The impact of AI on intermediaries is worth watching. Today's economy is able to employ the number of workers that it does due to a large number of intermediaries. In theory these may seem like "wasteful" signs of an "inefficient market", but they do enable large numbers of people to earn an income. These incomes in turn allow governments to shift tax burdens from corporations to these same individuals. The unspoken contract has been that corporations will continue to employ these individuals. When this breaks down the musical chairs game will get interesting.

[emerging tech]

Coinbase: Send crypto with a phone number or email

The crypto sector is entering a new growth phase - the next big story after AI may be financial infrastructure modernization.

Example: Coinbase customers can now send funds directly to other Coinbase customers using their phone number, email address, or username. These Off-chain sends are instant, and incur no transaction fees. See step by step instructions here.

More developments:

- Consensys, the maker of MetaMask, is preparing for an IPO led by JPMorgan and Goldman Sachs—marking the first major crypto wallet to go public.

- Mastercard is set to acquire ZeroHash for nearly $2 billion, embedding stablecoin and tokenized-asset rails directly into its global payments network.

- Google’s decision to open the U.S. Play Store to alternative app payments creates a friendlier environment for crypto-based micropayments, NFT memberships, and fund transfers.

For investors, these moves may expand the “Magnificent 7” narrative beyond AI and chips into wallets, payments, and digital-asset settlement systems—the next frontier of tech-driven growth?

More broadly, this evolution points to a deeper economic need: expanding capital ownership. As wages continue to lag inflation, democratized access to tokenized assets, micro-investments, and digital ownership tools could help more individuals participate in wealth creation rather than being left behind.

Sources: Axios, Fortune, Android Authority.

Amazon's $11B AI data center: cascading investment impacts

Amazon just announced an $11B AI data center focused on training Anthropic models using its own Trainium chips. The project hints at how massive AI investments are working their way through the economy:

- Amazon signs a deal with Indiana Michigan Power

- Indiana Michigan Power now buying an Ohio based natural gas plant to help meet power supplies

- This in turn boosts demand for natural gas.

- (At the same time Amazon is laying off 14,000 workers)

This partnership emerges amid an extraordinary surge in AI infrastructure investment: Google, Meta, and Microsoft together spent approximately $80 billion in Q3 2025 on AI-related capital expenditures.

NVIDIA CEO Jensen Huang has publicly indicated he does not believe the market is in an “AI bubble,” projecting sales of up to 20 million Blackwell chips versus 4 million Hopper units.

Current coverage:

- Amazon Project Ranier AI Data Center goes live

- Business Insider: Big Tech’s AI Capex Spree

- Techmeme Coverage

- Amazon 11B AI data center to train Anthropic models

[change leadership learning series]

🔬Precision allows innovators to earn trust and investment

Learn how to leverage a precision mindset to gain the confidence of your stakeholders, sell your ideas and drive successful innovation. Change Leaders Don’t Downplay Risk — they dissect It.

Click here to start learning about a Precision Mindset.

💯Bonus: Top 5 Ways to Finish the Year Strong

Opinions expressed are those of the individuals and do not reflect the official positions of companies or organizations those individuals may be affiliated with. Not financial, investment or legal advice, and no offers for securities or investment opportunities are intended. Mentions should not be construed as endorsements. Authors or guests may hold assets discussed or may have interests in companies mentioned.

Member discussion